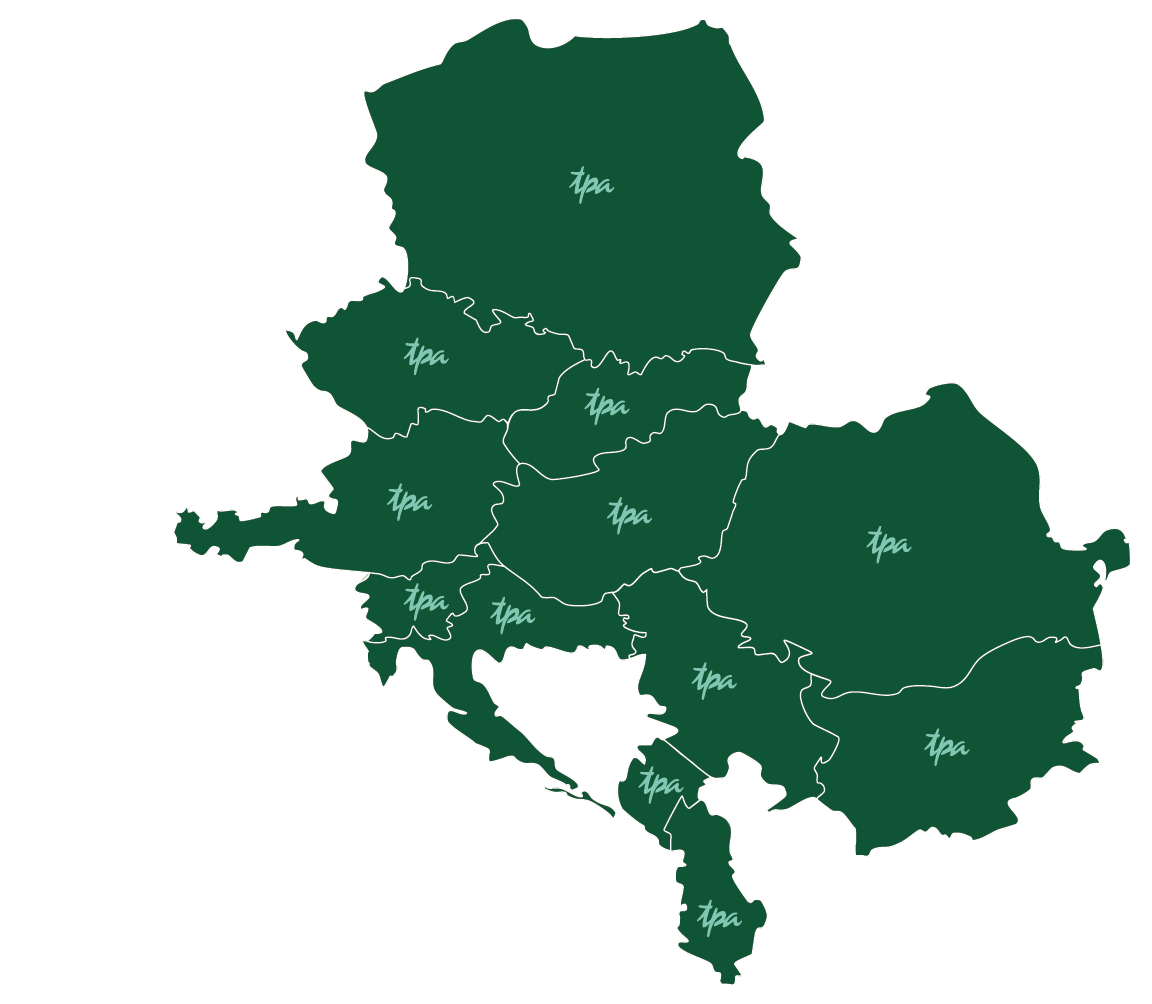

Support for your activities in Southeastern Europe

Southeastern Europe has undergone an impressive transformation and is now among the fastest-growing economic regions in the world. As a result, international companies have begun establishing regional headquarters for Southeastern Europe to coordinate their activities in these emerging markets.

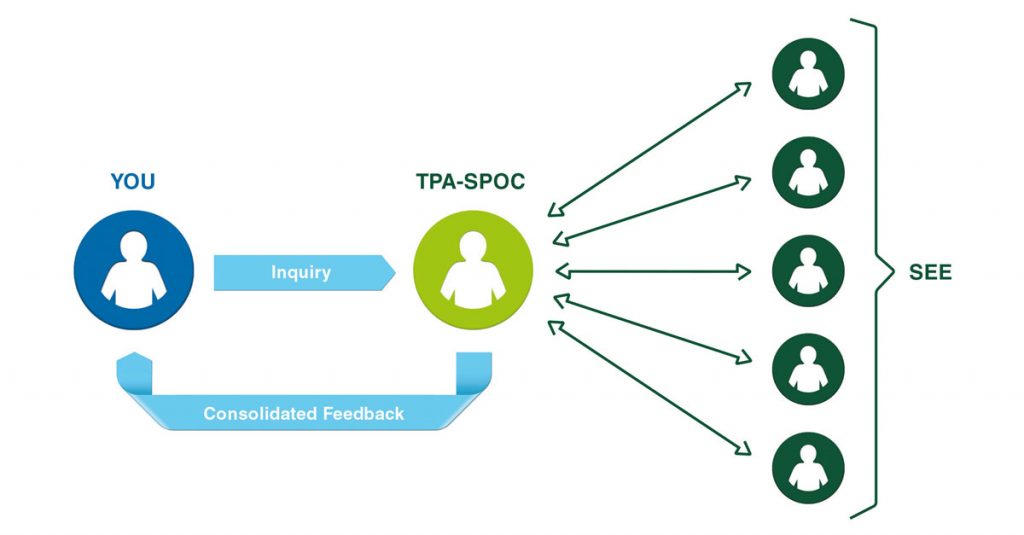

In today’s dynamic business environment, the ability to adapt is becoming increasingly important. One of the key challenges that regional headquarters in Southeastern Europe currently face is that when they have tax inquiries for multiple countries in the region, they must reach out to several local advisors, leading to a loss of valuable time.

A tremendous advantage for headquarters

We have answers to all your tax questions, especially:

- Expatriates

- Tax Due Diligence

- Special tax-related issues

- Tax structuring / national and international

- Transfer Pricing

- VAT consulting / national and international

- All other inquiries

Local roots. International success.

Our strength in providing effective transnational advice in the Southeastern European markets is exceptional and impressive. Thanks to our strong local roots in the countries of Southeastern Europe, we have developed a deep understanding of the specific tax and cultural characteristics of each individual market.

Your single point of contact: TPA experts for Southeastern Europe